Paper Market trends and supply updates from American Litho’s paper expert, Executive Vice President Chris Joyaux.

Volatility in the paper industry can hamper your ability to complete print projects in a timely, cost-effective way. To keep you informed, we bring you news and insights from paper expert Chris Joyaux.

It’s part of American Litho’s 360-degree commitment to help you reduce costs, increase relevancy, and achieve greater print ROI.

Through our strategic partnerships with manufacturers and distributors, are confident we can offer you the quality stock you need at competitive prices.

Below are comments from Alitho’s industry sources on the current paper outlook and upcoming trends.

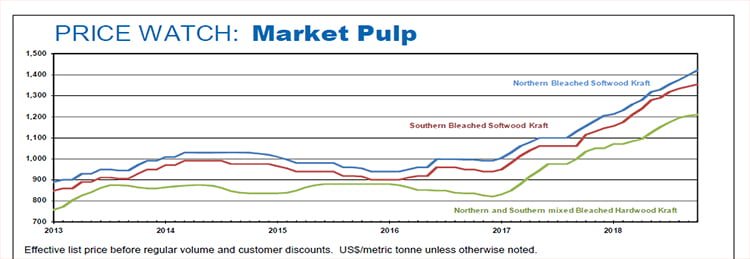

In a story released by PPI Pulp & Paper Week, Resolute adds a $20-30 November pulp price hike, but US buyer pushback seen as China BSK spirals down $40. Producers pushed through $10-30/tonne price increases for US bleached softwood kraft (BSK) market pulp in October, and at least two major producers announced fresh $20-30 increases, effective Nov. 1. Benchmark northern bleached softwood kraft (NBSK) final effective list prices increased $30 to $1,420/tonne, according to PPI Pulp & Paper Week polling, but southern bleached softwood kraft (SBSK) edged up just $10 aftermarket participants reported less upwards momentum despite output losses at three producers after two hurricanes in the Southeast forced pulp mill downtime. This week, major producer Resolute Forest Products (Resolute) announced a $20-30/tonne increase across its grades, industry sources told P&PW. In hardwood markets, Alberta-Pacific (Alpac) also announced a $20 increase. Domestic hardwood supplies tightened in the US Northeast after Woodland Pulp recently took significantly longer than scheduled downtime, market participants said. Read More on the pulp pricing trends – https://www.risiinfo.com/industry-news/

American Litho sources were made privy to the following announcement by Catalyst President and CEO.

Dear Customer,

I am writing today to share with you that Catalyst Paper Corporation has entered into an agreement for the sale of our business in British Columbia, Canada, in its entirety, to Paper Excellence Canada.

In purchasing all of Catalyst’s shares, Paper Excellence will acquire our pulp and paper mills in Crofton, Port Alberni, and Powell River, as well as our Surrey Distribution Centre, Richmond administrative office and our Seattle sales office.

This transaction is good news for our customers, employees, the communities where we operate, and the BC’s Pulp and Paper and Forest products industries. It will put our operations on a stronger footing. The transaction will be subject to a pre-closing review and clearance by the Competition Bureau, which is customary for a transaction of this size. We expect the transaction will close by end of the year or early 2019.

Paper Excellence is privately owned and headquartered in BC. They have five operating mills in Canada and two in France.

Together with Paper Excellence, our immediate goal is to make the transaction as seamless as possible. We do not anticipate any immediate changes once the transaction closes.

Your sales and customer service representatives will remain unchanged, and you will continue to receive the same high-quality paper products and service you have come to expect.

We are committed to working with you to ensure your needs are met as a valuable customer in the days ahead. Your sales representatives will be calling you shortly to discuss further.

On behalf of Catalyst Paper, thank you for your patience and understanding during this time, and for your business and partnership.

Sincerely,

Ned Dwyer

President and Chief Executive Officer

In case you missed it, below is breaking news coverage of New-Indy acquisition of Catawba mill; suggesting a phased transition to packaging paper [BMO] as shared with American Litho.

NEW YORK, Oct. 3, 2018 (Viewpoint) – excerpt from BMO Capital Markets

Resolute Forest Products is selling its big Catawba, SC market pulp and light-weight coated paper mill to privately held New-Indy for $300MM. A press release suggests that the mill will produce existing products as well as lightweight containerboard — suggesting a phased transition to packaging paper. This transaction had been widely discussed within the trade and was the subject of a recent BMO Research note, Another Containerboard Conversion in Pipeline?

Key Points

New-Indy is a containerboard/corrugated joint-venture between the Kraft Group and the Schwarz Partners. New-Indy currently owns three recycled containerboard mills and downstream converting assets. In 2015, New-Indy acquired Carolina Container, a major regional independent corrugated converter. In addition, both partners have extensive containerboard/corrugated packaging assets separate from the JV. The Schwarz Group controls North America’s largest system of corrugated sheet feeders and consumes 1.5MM/tpy of containerboard. The Kraft Group has a containerboard mill and box plants in New England and is also a major global broker of forest products (pulp, containerboard, wastepaper, etc.). Thus, the JV and its owners are uniquely positioned to internalize or market output from Catawba.

Catawba is large and relatively well-capitalized. With this deal, New-Indy has bought a lot of good assets for a modest price. The key will be making money from the assets. Both partners have proven remarkably adept on that front. Catawba produces market pulp and has three large coated paper machines (two of which are idled). From a size perspective, the machines appear well suited to producing containerboard for the latest generation of 100″+ corrugators. From the press release, it is not clear how/when Catawba will transition to containerboard. With the pulp and coated paper markets quite strong at the moment, we think a sensible strategy would be to harvest cash in those cyclically strong markets and begin producing containerboard (presumably, recycled containerboard) on one of the mill’s two idled machines. The owners could then let market conditions dictate the timing on further conversion moves.

How big is IP’s umbrella? Healthy margins and the implied promise of market stability are creating an inviting investment opportunity for smaller players in the containerboard sector. Rising containerboard prices, lower recycled fiber costs and the implicit assumption that the industry’s largest players will “balance” the market is inviting investment by several small/mid-tier players: Bio-Pappel (McKinley), Cascades, Green Bay, New-Indy, Pratt Industries and Verso. There may be more announcements in the pipeline. We think Domtar is likely to move forward with plans to begin converting white paper capacity to containerboard. European-based David S Smith has acquired two existing mills on the East Coast and reportedly looked at Catawba.

American Litho sources provide an update from RISI on the recently announced (and expected October close) purchase of Pulp mill.

ND Paper’s planned buy of Fairmont mill seen as both a ‘hedge’ and, ultimately, as a fiber helper for China

OAKLAND, CA, Sept 7, 2018 (PPI Pulp & Paper Week) – ND Paper is expected to continue producing market deinked pulp (MDIP) made from primarily sorted office paper (SOP) for at least the short-term following its expected purchase of Resolute Forest Product’s 240,000 tons/yr MDIP mill in Fairmont, WV. The acquisition is expected to close either at the end of this month or in October.

Most industry contacts interviewed this week said the mill will continue running SOP and an overriding majority expected that eventually, ND Paper would change the operation to make recycled pulp out of mixed paper and likely old corrugated containers (OCC) for shipment to its parent’s large containerboard and boxboard mills in China. Contacts believed this because of today’s fiber shortage in China caused by an array of Chinese government crackdowns on imported recovered paper. US recovered paper exports to China this year are down by 40%. Further, the Chinese government recently indicated it was considering a full-out ban of recovered paper imports in or by 2020.

One US supplier said the Fairmont acquisition is a “hedge for 2020” for Asia’s largest paper producer Nine Dragons. Nine Dragons is the second-largest containerboard producer in the world behind International Paper.

“They will stay with white for as long as they can,” a large exporter said.

Another agreed, saying: “They’re not going to do anything now. Everything they do now (in terms of acquisitions) is for preparation” for what may occur in 2020.

This would be ND Paper’s third mill acquisition in three months, assuming the deal is finalized. In July, ND Paper completed the acquisition of two Catalyst Paper pulp and groundwood/coated printing and writing papers in Rumford, ME, and Biron, WI.

“Imagine that, Chinese mills are buying US mills to ship (the fiber) back to China,” said a processor in the Northeast.

“That told us they were serious about the changes in China. The way they’re spending the money, we know it’s long-term,” said another.

What’s unique about Fairmont is that it has a top pulper system and is one of two US mills that make air-dried deinked pulp. The other is Resolute’s MDIP operation in Menominee, MI.

Some industry contacts, a minority, this week believed that ND Paper would swiftly switch to making a mixed paper/OCC air-dried recycled pulp. They even expected a changeover within four to eight weeks.

Either way, market impacts were expected, the industry contacts told PPI Pulp & Paper Week. ND Paper was contacted for comment by P&PW on Sept. 4 and did not comment.

“They didn’t buy the mill for the white fiber,” said an industry contact. “They’re going to run for a while in white and change it to mixed fiber and brown.”

A large SOP supplier expected reduced SOP pricing if ND Paper jumped from MDIP to mixed paper first/OCC pulp. He said this because Fairmont now buys about 30,000 tons/month of high grades. SOP pricing today is on an almost year-long runup and up by 35% nationally for domestic mills from a year ago, according toP&PW‘s survey as of Sept. 6. He also noted that ND Paper and Nine Dragons affiliate America Chung Nam was claimed to have recently won, for the first time, about an 8% share of 600,000 tons/yr of Shred-It SOP that took effect on the market as of Sept. 1. If ND Paper continued making MDIP, SOP pricing would “certainly” remain elevated, noting reduced generation and steady recycled-content tissue mill demand, another industry contact said.

One claimed Menominee is already “almost sold out.” Menominee would likely be inundated with new demand if Fairmont moved out of MDIP, an industry contact said.

If Fairmont jumped to mixed paper, it would “definitely” help the domestic mixed paper market, one said. Most expected ND Paper would start with making as much mixed paper pulp as it can until it determines the proper mix for making strong enough containerboard with the furnish in China.

However, another said that making recycled pulp will run “a couple hundred dollars” more than direct buying of OCC No. 12.

The source said Fairmont should make mostly OCC with a minority of mixed roll pulp. To make a furnish mostly or fully out of mixed paper would be too costly, he said. Recycled pulp delivered to China was at about $430/tonne for the mixed grade and $480-500/tonne for the OCC grade as of Sept. 5. US OCC No. 12 to China ports was around $250-280/tonne CFR to China ports on Sept. 5 (See market story, p. 1).

Recycled pulp, OCC bids. Another contact questioned recycled pulp when Nine Dragons and ND Paper affiliate America Chung Nam “has won bids at high prices” recently for high-quality US OCC, one industry contact claimed. One of those was for Walmart OCC.

Single-stream material recovery facility companies such as Waste Management and Republic Services would benefit if Fairmont changes output mixes, industry contacts said. This would occur, if soon, as mixed paper domestically is at about $0/ton at the FOB seller’s dock and has plummeted since China banned imports of the material at the end of last year. The US had sold more than two million tons/yr of mixed paper to China.

Fiber short. Contacts believe the recent moves by ND Paper means that Nine Dragons, which recently announced that it expects at least a 60% increase in profit for its last second-month period, is now caught short of fiber and/or concerned about its fiber position going forward into next year.

Mills in the last six months in China have been taking downtime due to lack of fiber. China has been buying recycled pulp from Southeast Asia, and containerboard from Southeast Asia and other global markets while continuing to require cleaner US material. The US has been China’s largest exporter with a 40-45% share of its global imports. Even so, US exports to China are down by about 40% this year, with no residential single-stream material allowed for import and only cleaner grades such as the OCC No. 12, new double-lined kraft corrugated cuttings, SOP, and high-quality old newspapers such as No. 9 and coated groundwood sections/old magazines.

Also, both Nine Dragons and Lee & Man Paper, the two largest containerboard producers in China, plan 1.2 million tonnes/yr and 400,000 tonnes/yr board machines in Vietnam next year. Contacts believe some of all the Vietnam board will end up in China. Vietnam warehouses. Some US companies now plan warehouses in Vietnam. “The Chinese are playing their game now in Vietnam — to supply their mills in China,” a supplier said.

Paper Trends – American Litho recently received some news on LTL carrier pricing effecting shippers and an August report on the paper market front.

LTL carriers taking contract price hikes to shippers

Less-than-truckload (LTL) shippers heading into annual contract talks with carriers this quarter should brace for another round of rate increases. The largest public LTL operators claimed mid-to-high-single-digit contract rate increases in the second quarter, and they’re not finished. LTL contract rates “don’t appear to have peaked,” Darren Hawkins, CEO of YRC Worldwide, told investment analysts on Aug. 2. In the second quarter, year-over-year rate increases won in contract renewals averaged 7.2 percent at YRC Freight, the company’s national LTL carrier. Trucking contract negotiations occur throughout the year, and half or more of some Prices aren’t simply rising with the market, however. “We certainly have a better handle on what we’re pricing than at any time in my career,” Hawkins said during an earnings call. Technology that accurately measures the dimensions and weight of palletized shipments is helping.

Read the full article here – https://www.joc.com/print/3443436

—

More news from the paper market front, below are some key market indicators and statistics.

Key Market News (RISI, PPPC, USPS)

- Verso sets 4‐6% Sept. 7 price increase on CFS rolls and sheets

- US packaging papers and specialty packaging shipments up 5.7% in July from a year ago – AF&PA

- Veritiv 2Q 2018 results: net sales up 7% from a year ago to $2.2 billion

- US Postal Service 3Q 2018 results: revenue up 2.4% from years ago to $17.1 billion

- Kruger Products to invest $575 million to build new, 70,000 tonnes/yr tissue plant in Quebec, to commence production in early 2021

- US supercalendered paper trade settlement allows Nova Scotia’s Port Hawkesbury Paper mill to ‘focus on future’

Paper Segments Monthly Statistics (PPPC)

- Newsprint: Demand fell ‐11.6%. Shipments declined

- ‐5.9%. Shipments to capacity at 100.5%.

- Uncoated Groundwood: Demand fell ‐4.4%. Shipments were up by 0.8%. Shipments to capacity at 92%.

- Uncoated Freesheet: Demand was up 1.3%. Shipments were down by ‐2.6%. Shipments to capacity at 91%.

- Coated Groundwood: Demand fell ‐4.0%. Shipments declined ‐11.6%. Shipments to capacity at 91%.

- Coated Freesheet: Demand fell ‐4.7%. Shipments decreased by ‐10.5%. Shipments to capacity at 88%.

Read More: https://www.alitho.com/wp-content/uploads/2018/08/Veritiv-Paper-Market-Update-August-2018-V2.pdf

—

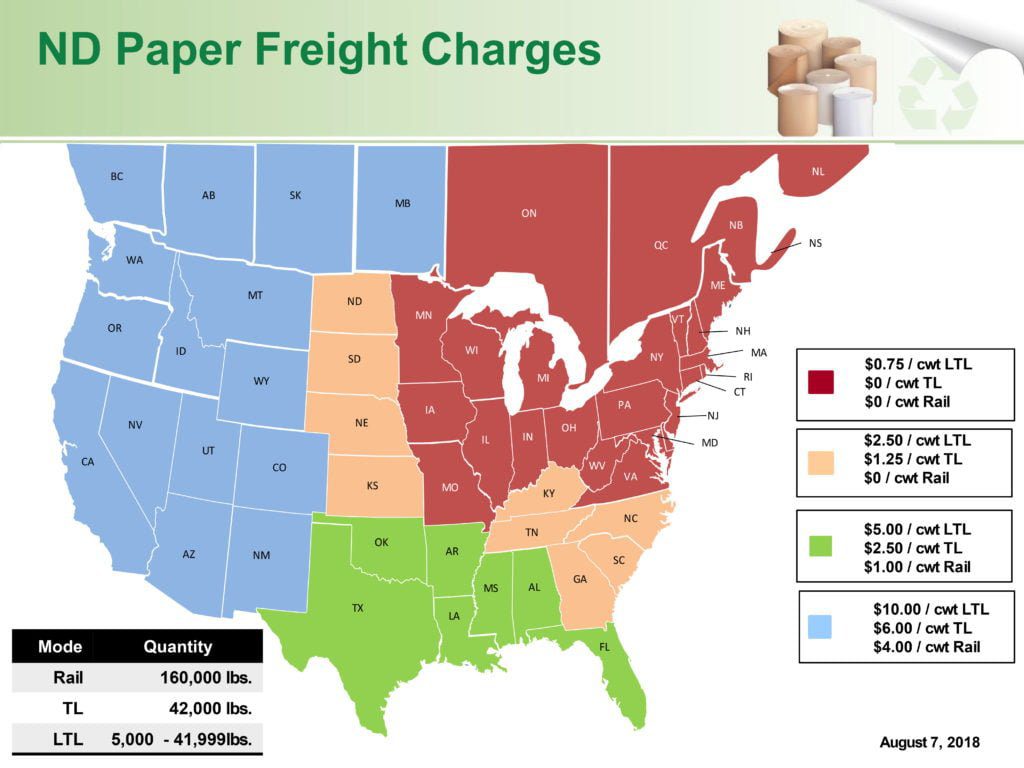

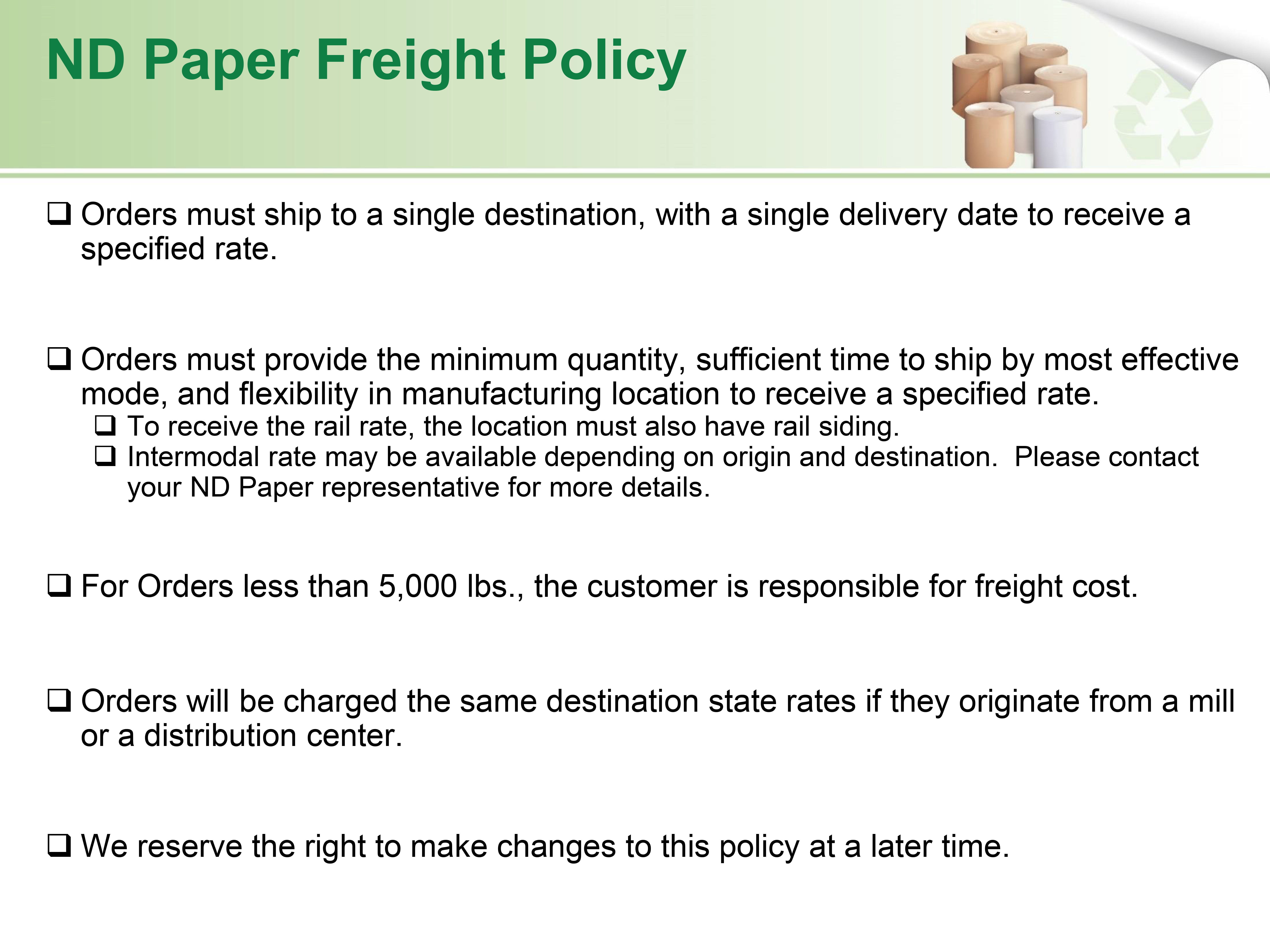

This news was recently shared from ND Paper on their Freight Policy. Contact American Litho on additional details on this policy change.

ND Paper is announcing a revision to our freight charge policy. As a newly formed entity, we have aligned our freight policy with our current geographic manufacturing footprint. The intention of the new policy is to maintain as many destinations as full freight allowed (FFA) as practical given today’s freight market. Our new policy will allow for more than 80% of the current volume shipped from ND Paper to have an FFA option. The policy provides a simple view of charges across the continental United States and Canada.

Some highlights of the attached policy are:

- Charges will be applied by destination state/province and mode of transportation

- Shipments from warehouses will be charged the same as shipments from manufacturing facilities

- Charges apply to all products from either our Biron, WI or Rumford, ME mills

- The policy is effective for new and existing orders with confirmed delivery dates of September 4, 2018, and later

—

Paper Trends – American Litho recently received some news on the future of the ND Rumford and Biron mills. Below are the highlights of what was shared and clarification of the issues raised in a recently retracted RISI article (July 2018).

Rumor: The product mix at the Rumford Mill will be converted to 100% market pulp, all of which will be sent to Chinese Nine Dragons paper mills.

Reality: False. In addition to producing ~550,000 metric tonnes of paper, the Rumford Mill has over 100,000 tonnes of annual market pulp capacity; the mill has sufficient pulping capacity to support both paper and pulp product categories. While some market pulp may be shipped to Chinese mills, ND Paper remains committed to its core Printing/Writing & Specialty Paper customers.

Rumor: ND Paper is implementing strategic plans to convert the entirety of its asset base to containerboard production.

Reality: Not true. We recognize that, despite current market tightness, the demand for traditional printing and writing paper grades is declining. With that, a strategic evaluation of our asset base is fundamental and necessary to preserve the ongoing viability of our operations. Importantly, this strategic evaluation is not yet complete; we have not yet arrived at any definitive conclusions. It is safe to say, however, that converting Rumford to pulp-only is not among them. We are proud to operate some of the leading Printing/Writing & Specialty Paper machines in North America, and we intend to be in the business for the long haul.

—

Sappi North America announces a transactional price increase on new and unconfirmed orders that book with confirmed delivery dates on or after Monday, July 23, 2018 on the following products:

A $3.00 per CWT US$/$4.00 per CWT CAD$ increase on < 60#/89gsm:

- Somerset Web

- Flo Web

- Galerie Web

A $1.00 per CWT US$/$1.30 per CWT CAD$ increase on ≥ 60#/89gsm:

- McCoy Web

- Opus Web

- Somerset Web

- Flo Web

- Galerie Web

Standard differentials and upcharges apply. This price increase includes all private label programs.

Contact American Litho for additional insights on Sappi paper supplies.

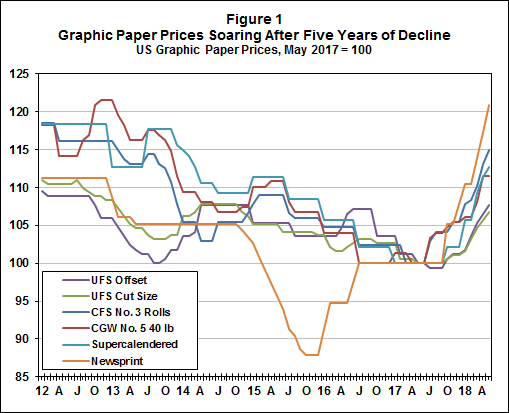

How much longer can graphic paper prices climb?—

BEDFORD, MA, June 2018 (Viewpoint) – By Derek Mahlburg, Senior Economist, North American Graphic Paper

Although the decline of print publishing and advertising is a persistent problem for many graphic paper buyers, the downward trajectory of graphic paper prices in 2012-2016 made the ongoing loss of market share and revenues to digital media somewhat more manageable. The five-year descent of pricing has sharply reversed since mid-2017, however, with US graphic paper prices in May 2018 already 7-21% higher than their year-ago levels. Uncoated freesheet prices, which have been more stable than those of coated and mechanical papers since 2012, are up by a relatively modest 7-8%, while coated paper prices are up by 11-15% year over year. US newsprint prices experienced the most dramatic descent over the past five years, but the recovery since late 2017 has been just as impressive; powered by tight market conditions and tariffs of 28% or more on many Canadian mills, US newsprint prices are up by a whopping 21-24% over the past 12 months, and producers with steep tariffs have successfully implemented even larger gains. For paper buyers that have grown accustomed to stable or even declining prices over the past five years, the soaring prices of 2018 are a rough revival of rising paper costs.

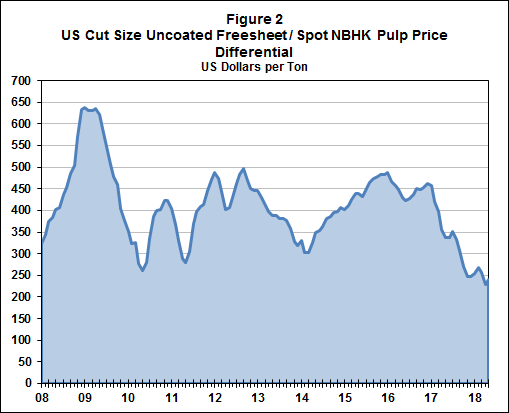

An important factor enabling the price declines prior to 2017 was the steady retreat of paper production costs. The decline in production costs ended in 2016, with increases in costs for chemicals, delivery and, of course, market pulp, all playing major roles in reversing the downward trend as general cost inflation also began to heat up in the general US economy. The ascent of US pulp prices, which have risen by 30% since the beginning of 2017, helps to put some of the double-digit pricing gains for graphic paper into perspective. Thanks to skyrocketing pulp prices, the price differential between market pulp and uncoated freesheet is now at its lowest point in the past decade, and if the continuing parade of market pulp supply shocks results in more price gains, the gap will narrow even further unless paper prices climb further as well. Other upward cost pressures include transportation bottlenecks and US tariffs of up to 16% on supercalendered paper and up to 32% on all other non-directory grades of uncoated mechanical, including newsprint, from Canada.

Ultimately, producers’ ability to pass on cost inflation and maintain healthy margins depends on the supply/demand balance. On the supply side, prices fell by more than costs in 2012-2016, putting profitability for coated paper at all-time lows and triggering a major round of capacity rationalization that has supported the market conditions that have allowed prices and margins to recover, especially for non-integrated producers who do not need to buy market pulp. US printing & writing seasonally adjusted operating rates were at 93% through the first four months of 2018 compared to 90% through the first four months of 2017, and the prospect of more conversions to specialties and packaging will help keep capacity in line with demand.

Whether capacity is adjusted quickly enough also depends on the speed of the demand decline, which may be exacerbated by the size of the price increases. Paper represented about 10% of operating costs for the largest public US magazine publisher in 2017, so the coated paper price increases of 10-15% already in place represent a little more than one percentage point of a handicap for operating margins. For newspaper publishers, paper accounts for about 5% of operating costs, so the 2018 paper cost inflation will have a similar absolute impact on profitability, but newspapers have very narrow margins. Although one percentage point of operating income may seem like a modest amount, most of the newspaper publishers that we track already have operating margins of 6% or less, and all but one experienced a revenue decline of at least 4% in 2017, so price increases will bring force buyers to bring paper conservation back into focus and increase subscription prices. Even if increased subscription prices help keep publisher revenues stable, they will result in decreased circulation and negatively impact paper demand.

US prices have climbed a great deal already since 2017, and more price increases are on the table for every grade of graphic paper. Some of the factors pushing prices up include cost inflation and capacity reductions that have boosted operating rates, while the demand side of the supply/demand picture continues to provide downward pressure and presents additional risk via price elasticity. RISI’s forecasts for how these opposing forces will balance out are available in the latest Paper Trader and North American Graphic Paper 5-Year Forecast.

(PPI Pulp & Paper Week) – A new $50/ton May price increase began taking effect for North American uncoated freesheet (UFS) paper this month with virtually no equivocation from buyers, contacts reported. Customers continued to face scarcity of supply and lengthening mill backlogs.

Papermakers were holding customer orders to historic averages for both offset and cutsize paper, and have machine backlogs of up to 60-90 days, mill, and merchant contacts said.

“UFS rolls are super hard to come by and delivery dates are pushed out,” one contact with a major commercial printer confirmed.

“There’s not enough paper to go around … hard to believe,” one merchant source said.

“There’s no delays and no negotiations (on price),” another merchant contact said. “It’s not a question of pricing, it’s a question of can you get the order in, because if you don’t, you’re out in July.

“There seems to be more panic in the air,” a mill source said. “I’m getting crazy phone calls. You can hear the panic in their voice if they don’t have a position – there’s desperation to get tons.”

Buyer sources emphasized the importance of supplier and mill relationships in the new market dynamic.

“Customers who ran to the lowest price are coming running back, but people are not quoting for them,” one merchant source said. “If you’re not an existing customer, you just don’t get (paper). Mills can’t entertain any new business until they catch up and they don’t know when that is going to be.”

“Mills are sold out on commodity/commercial offset basis weights … current shipping dates can range from August through the end of 2018,” another merchant contact said.

“We’re typically out a month (on backlogs) but we’re pricing orders in August ‒ and August will most likely be full by the time we get started in June,” one mill contact said.

Move to opaques.

Mill sources said they are trying their best to accommodate customers with paper, and product mix is a part of that.

“You may be able to get value-added tons but not commodity tons,” one merchant said.

“Some people are moving up to higher quality if they don’t have a floor position or customer inventory position, for example by moving to opaque from offset,” confirmed a mill source.

“(Customers) are buying higher-priced brands if they can’t get commodity offset. We’re seeing a huge increase in opaques – at least double our previous orders,” another mill contact said. “We hope end users like the higher quality product and decide to stick with it.”

Contacts said supply has dried up faster than suppliers’ ability to meet demand, and the ensuing tightness is being compounded by mills taking maintenance at what is historically a seasonally slower time.

“Some are late in delivering orders in an already stressed system coming off seasonal maintenance outages,” one source said.

Contacts also said some manufacturers who were tempted to postpone machine maintenance and continue running flat out have reportedly experienced equipment issues and/or product rejects that required shutdowns.

“When you get tight, then (maintenance) really gets problematic. It doesn’t take much downtime to get things out of whack,” a mill source said.

A fall supply crunch?

“They’re having problems keeping up,” a merchant source observed.

Merchant sources also said they worried about some customers’ difficulty understanding that “prices don’t always go down,” and inability to plan ahead given concerns about a supply crunch at the end of the summer.

“We have some customers totally insulated from the market who don’t understand why they can’t get paper in two weeks,” one merchant contact said.

Most domestic UFS producers’ increases became effective in the second or third week of May, so a full month of implementation is not yet in place. Also, according to supplier sources, a lot of customers start paying the increase next month, with the largest portion in June and the rest the following month when the new quarter starts. Those who saw an immediate increase estimated prices have increased $40-50/ton in the past 30 days.

“I think the full May increase will go through. It might take two months, but it will go through,” a commercial printer contact forecast.

Many sources also spoke of the likelihood of another increase later in the year.

“Look at the projected UFS decline and overlay that with what’s scheduled to be taken out and I can’t see anything changing any time soon ‒ especially with the pulp market pushing up raw material costs,” one said.

“We’re really worried about the fall. Come August-September, mills that have been robbing Peter (from inventory) to pay Paul won’t be able to pay Peter,” said another merchant contact. “UFS supply will loosen up a bit in June but if the smart people fill up, inventory is flushed out of the system, and with the uptick in demand, I will not be surprised if we see another increase in the fall.”

“Buyers think you’re making millions of dollars when the price goes up, but with the price of fiber, we really need increases,” a mill contact said. “We’re certainly not where we thought we’d be. It’s a period when you try to get your commodities lined up to get through the next trough.”

Cenveo set a 5% price increase on all envelope grades effective with July 2nd shipments, citing ongoing market conditions and the rise of raw material costs including paper and freight increases. “These are challenging times for our industry with material increases and continued unprecedented issues around freight capacity and escalating costs,” the firm told customers.

Successfully navigating the trucking and paper crisis is all about planning ahead

May 2018

Electronic drivers logs are putting additional pressures on the trucking industry, placing greater emphasis on thoughtful planning.

This is primarily due to the new regulations in the trucking industry.

For every 10 truckloads of product that need to be shipped, there are only enough drivers and equipment available for 6.6 of them.

This has created a bidding was. We hear this weekly: “Don’t count on that truck showing up at your door until it does”.

Numerous times we have expected a truck to pull up for an outbound load, (only after calling) to find out the carrier took another load that paid more or the driver assigned to the load ran out of driving hours. This situation is not going to improve anytime soon.

The best way to deal with this issue is to plan ahead:

- Don’t wait until the last minute to place orders.

- Take the time to educate your customers. They have a stake too.

Now let’s review the current conditions in the paper market.

If we look at where we were last year, the market for uncoated free sheet was around 7,500,000 tons. Of that approximately 1.200.000 tons have either been taken out of the market or are scheduled to be taken out. That is a 15.8% reduction I tons of uncoated free sheet available in the US.

Operating rates last fall were in the 88% range and have soured to over 95% in the first quarter of this year. The paper mills are no longer in an over-capacity situation and are now pushing through price increases that we have not seen since the 90’s.

$2.00/cwt last October, $2.00/cwt in February of this year and another $2.59/cwt going into place in May. Most mills have their customers on allocation not allowing for the buy-ins that we saw in years past.

The mills are now in the process of their annual spring shut down for maintenance. This is helping to keep the backlogs strong and when this is completed, it will be back to school time as they look to build their cut sheet inventories.

The key to managing these hurdles is good communication. No one can guess when the next increase may be, or know when lead times will be pushed out even further. Be sure to keep your customers informed of what and why some of these conditions happen.

Drivers Under Pressure: Trucking Woes Fuel Shift to Rail Transport

May 2018

The growing crisis in long-distance trucking shows no signs of stopping. New federal regulations require drivers to electronically log the road hours they put in, which experts say will lead to greater compliance with the mandated 11-hour limit on driving shifts. Combined with the current shortage of qualified drivers, the new regulation will add even greater time pressures to an already stressed system – likely leading to higher logistics costs in 2018.

Seeking cost-saving alternatives on behalf of their clients, commercial printers and direct mail houses are turning to intermodal transport, using railways in tandem with long-distance trucking as an efficient route for paper stock deliveries. American Litho is on the cutting edge of this trend, with regular rail deliveries coming directly to our 320,000-square-foot facility in Carol Stream.

Read more about the shift to intermodal transport here.

Paper Market and Industry Trends

February 2018

We have seen a number of price increases for all paper grades starting last July and the possibility exists this year. Below is the latest in market intel and trends.

- 40% of capacity is out since 2000.

- In the last 8 years, 1,240,000 tons have been removed from the paper industry

- In 2017 alone, 655,000 tons were removed because of Appleton and West Linn.

- Groundwood has lost 56% of its capacity since 2000.

- Of the top 5 remaining producers, only 2 are domestic (Sappi and Verso)

- Pulp is up $11/cwt since December 2016.

- Mills that do not produce pulp were Appleton and West Linn

- There was a graph of web prices from 2008 to 2018. Pricing is still below where it was in 2008.

- There is more volatility in pricing as you go down in grades.

- For the first time in US history, there were two Category 4 Hurricanes which made landfall.

- Discussion of the ELDs (electronic on board recorders) to record hours of service in trucks. This is reducing trucking capacity. Some smaller truckers just left the industry. Plus there is a shortage of drivers.

Every trucker can pick between 3 – 6 choices for his next load. Sappi is working hard to be the “Shipper of Choice”. Meaning that truckers do not have to wait to either load or unload. This was suggested for printers as well.

- PIA 2018 forecast projects print sales to increase 1.5 – 2.5% this year. Packaging, labeling, signage, POP, and direct mail are all segments expected to grow.

- Sappi and Catalyst are on web allocation NOW.

- Sappi is moving into the packaging world.

- Therefore, at the end of March through April, Sappi is taking 1 machine out of production to move it to packaging. That means 20% less product being produced in March.

OPINION I U.S. ECONOMY

February 9, 2018

Bloomberg released this report, the supply of truckers isn’t rising, so freight prices will soar and cut down demand. That’s bad for the whole economy.

Read More – The U.S. Is Running Out of Truckers

SAPPI Paper Price Increase

January 31st, 2018

Effective on the first of this month, Sappi North American has begun a price increase on orders that have been booked with a delivery date on or after February 5.

This 4%-7% transactional price increase is relevant to the following products:

- McCoy Web

- Opus Web

- Somerset Web

- Flo Web

- Galerie Web

Coated Stocks Resolute Price Increase

January 31st, 2018

Effective March 1, Resolute Forest Products will raise its ResoluteGloss, ResoluteBlonde, and ResoluteBrite 76 papers by $40 US/st.

While this change in coated paper price was something American Litho anticipated last year, we continue to work strategically to minimize the impact on your brand.

Catalyst Paper Price Increase

January 31st, 2018

Beginning on the first of next month, the transaction price for several grades of Catalyst paper will be increasing by $2.00/cwt. The Coated Freesheet Grades increasing include Orion and Vision, while the Coated Groundwood Grades include Escanaba, Dependoweb, Capri, and Consoweb.

American Litho continues to watch and anticipate changes in Coated Stock pricing, partnering closely with supply chain partners to get you the greatest value.

Truck Shortage Forcing Companies to Cut Shipments or Pay Up

January 25th, 2018

We are working closely to monitor the nationwide trucking shortage. Factors like record-level freight volume and bad weather means the hard choice between:

- Postponing all deliveries

- Paying more to jump in front of the line.

Read more about the shortage here.

American Litho is working with national and local trucking partners to minimize costs increases and keep your shipments at the front of the line.